You play poker. You don’t play the market.

I came across the headline below and alternated between laughing and crying. CNBC, one of THE leading financial news media outlets, is touting a ‘potential strategy’ that seems to appeal to the gambler in us.

With headlines like this, it’s no wonder that people think investing and gambling are the same.

How to play the stock? Smacks of Las Vegas.

I love Poker. I learned poker from my grandmother when I was 6 years old. We played for small stakes, only pennies and nickels. Now, my family gets together for very intense games. The stakes are a little higher. During those evenings, I’m always trying to play my hand right. That’s poker. That’s gambling. But playing Apple? That makes me nervous.

So, the headline is designed to grab attention. I get that. But let’s play this out. (Pun intended) How exactly would one play the Apple stock trade?

Would you buy it for a moment then sell it? Or buy it, but only after it goes down and then quickly sell it once it goes up 10%? I’m sure there are many trading strategies. Alas, when I clicked on the article to find the secret sauce, I discovered I could only get the answer after buying a subscription to their research offering.

My advice to you. Save money on the subscription.

Rather than play Apple? How about we invest in Apple?

Better yet. Invest in Apple for the long term. I know that headline doesn’t sizzle, but I like it. My plan is to own the stock, and own it for a long, long, long, long, long time.

(Before we go on, it’s important to say I’m using the example of Apple and this headline only to illustrate a broader lesson, I’m not suggesting that you should buy Apple right now)

Let’s look at what history would have told us was the best way to invest in Apple. Or play it. History would say that holding Apple for the long term would have been the best way to play the stock.

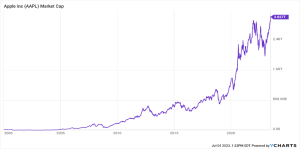

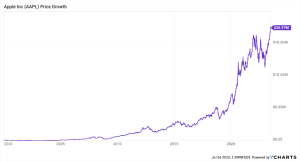

In 2000, Apple’s market cap was under twenty billion. Now it is over Three Trillion.*

If you had put 100K into the stock in January of 2000 you now would have had 18.26 million dollars*

Seems easy right? Not so fast. You need to strong stomach to ‘buy and hold’ To have earned those amazingly mindboggling returns, you would have had to hold on to Apple as it lost over 50% of its value. Not once, but four separate times. At one time, Apple’s loss from top to bottom was over 70%!

To add insult to injury, there were an additional SEVEN times Apple stock lost more than 30% after hitting all-time highs.

Imagine, at any of those downturns you chose to ‘play’ Apple (whatever that means) and sell, only to wait later to buy.

Would you have achieved the same results as just holding? Maybe, but I’m guessing not.

There are so many lessons here, but the one I want to impart to you today is that ‘playing your hand’ successfully investing often means DOING NOTHING.

In professional poker, this translates into patiently waiting folding hands. Did you know that professional poker players fold their hands (before betting) as much as 75% of the time! If that sounds boring, it’s because it is. This doesn’t make for good T.V. so you never see this at televised poker tournaments. However, they are professionals for a reason and enjoy earning a living playing games because they adhere to a system.

That system includes discipline, patience and sticking to their plan. They fold hands. They wait.

Interesting. Discipline and patience. Maybe investing after all is a little like gambling?

Good investing can also be like piloting a plane. There is a saying that flying is ”Hours and hours of boredom sprinkled in with a few seconds of sheer terror.’”

Successful investing is much the same.

While investing involves doing nothing most of the time, ‘sheer terror’ comes along ever so often. These moments come in the form of recessions, bear markets, a global pandemic, crazy high inflation, an airplane hitting a skyscraper in Manhattan. You get the idea.

It’s during those periods of time when the urge to ‘play the market’ will loom large. As evidenced by the headline from CNBC, you’ll be encouraged to actively make moves by some of the leading media outlets. Try to resist that temptation.

Warren Buffet says it best.

“If you aren’t willing to own stock for 10 years don’t even think about owning it for 10 minutes.’

So, the next time a little nervousness creeps into your life, remember, you’re an investor, not a gambler. You can do nothing.

Which may be the best ‘play’ after all.

Happy investing.

Tony

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.

The opinions and forecasts expressed are those of the author, and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results.”