Turning your Pile into a Paycheck: Part II:

The dangers of living too long: Inflation and Stock Market Risk

Quick summary:

In the introduction to our series called “Turning your Pile into a Paycheck. we posed the question:

How do you know how much you can withdraw from your TSP and be able to enjoy your retirement? We like to define ‘enjoying your retirement’ as investing you TSP so you can spend enough now while also having the confidence that you won’t run out of money later in life.

We firmly stated that retirement income investing is very different than retirement accumulation investing. Going down the mountain per say is actually harder than going up. We even coined the term SNS. Saving is not spending. (if you haven’t read part one please click here to access the article)

Why is this case? Why is it different?

There are 3 core considerations that are to blame: Longevity, Inflation and Market Risk.

The impact these forces have on retirement plans is profound and unavoidable so let’s dive in and learn more.

Key Consideration #1 Longevity. Without this, retirement would be easier.

Congratulations! You are probably going to live longer than you thought! Most of us will estimate our own life expectancy by looking at our parents. Family history is important, but it doesn’t tell the entire story.

Advances in modern medicine and nutrition means that most will probably live much longer than our parents. Just like many of our parents lived longer than their parents.

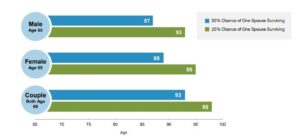

The chart illustrates the probability of living to various ages.

If you retire in your early 60’s and are married, there is a coinflip chance that either you or your spouse will be alive, needing money at age 93. That’s 27 years in retirement.

If you are Federal Law enforcement and must retire by 57 you could spend 35 plus years in retirement.

You might be in retirement longer than they worked at their agency. Let that sink in.

Key Consideration #2 With Longevity comes Inflation.

The idea of having a long, happy retirement should be an occasion for celebration! But it comes at a price, inflation.

Over a 1-year period, we may not notice the rising costs of the things we need, but over 5, 10 and especially 20 years, there is massive difference.

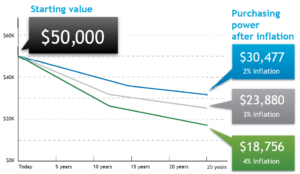

Check the chart below on how $50,000 in today’s dollars

Inflation is the real reason why living too long is hard on your investment plan. If you need to withdraw money from your TSP to maintain a standard of living, you are going to need to withdraw more each year to just maintain the status quo.

Beating inflation is simple—in theory. You need to earn a rate of return on your ‘pile’ greater than both the yearly rise in prices and your withdrawals. The only way to do that is invest for growth in retirement.

Is this guy actually advising me to invest my earned TSP into the market AFTER I retire?

Absolutely.

But as we will see next, investing for growth comes with an entire new set of challenges.

Key Considerations #3

There is no free lunch. Beating inflation comes at a price: Stock market risk.

As we said above, living longer introduces inflation risk. So, even though you retired, you are not done with the dreaded stock market just yet.

Sounds scary right? Yes and No.

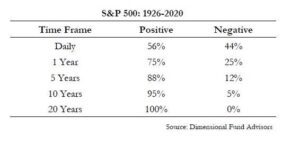

In fact, long-term investing in the stock market has been more rewarding than you think. Some people equate the market to a casino. That’s not accurate. The big between the casino and the market is that the longer you play the ‘market’ the greater the chance you walk away ahead. The longer you play the ‘casino’ the great the chance you walk away with no money.

See that chart below detailing the chances of gain over various time periods.

Staying the course with the market is great before retirement because time is on your side AND you don’t need the money you are investing. You already have a paycheck.

However, when you are creating your retirement paycheck from your TSP, even if in concert with your FERS pension and social security, maintaining a long view is infinitely harder. This is because even though the market is amazingly consistent over time, it is also amazingly inconsistent over short periods. Some of those shorter periods contain large losses.

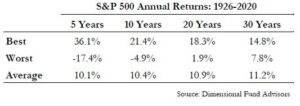

Take a look at the chart below illustrating the best, worst and average return for the market and let’s zoom in on the 5-year time frame. (The C-Fund tracks the S&P 500)

WE can see that the average return over a 5-year period is 10.1% soundly beating inflation.

We also know that 12% of time is the market is negative over 5 years. The worst 5-year return would cost you -17.4%.

What if you happen to retire in that stretch?

Even if you don’t retire in that unlucky window, chances are that over a long retirement you’ll be confronted with losses.

From the data below, we know the stock market loses money annually over 25% of the time. Sometimes by large amounts.

No good choices

So, what’s a retiree to do? Take risk and try to beat inflation? Or move it all into the G Fund or the L-Income and do your best to avoid market losses?

- Invest too conservatively, inflation will eat away your nest egg.

- Invest too aggressively and you risk stock market losses you can’t recover from.

One client said to me, ‘Wow, living long stinks, doesn’t it?”

Today’s retiree faces challenges that folks 20-30 years ago didn’t. This is why the what got you here may not necessarily get you there.

Longevity, Inflation and Market risk is why ‘saving is not spending.’

Now that we know more about the problem, let’s go deeper into the solutions.

Stay tuned for our next article!

Common Investment Distributions Strategies: The 4% rule and the Bucket Approach.

With over 19 years of experience as a financial planner, author and educator, Anthony Bucci helps Feds ‘cut through the noise’ and make retirement decisions free from opinion, emotion and conjecture. Find out more about Anthony by visiting www.missionpointplan.com

The opinions and forecasts expressed are those of the author, and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results.”

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.

LPL Financial and its representatives, Mission Point Planning and Retirement do not provide tax or estate planning advice. These are services are provided in conjunction with a qualified tax and/or estate planning professional.