Our Thoughts & Insight - TSP

The 3 Mission Critical Ingredients for a Successful Federal Retirement Plan

3 Mission Critical Ingredients for a Successful Federal Retirement Plan After decades of federal service, your retirement deserves more than vague assumptions and best guesses—it deserves a well-crafted, proactive plan. Whether you’re a FBI agent, a Letter Carrier or...

Lessons from Waterloo to Washington: How Federal Employees Can Conquer Market Chaos

From Waterloo to Washington: How Federal Employees Can Conquer Market Chaos I recently dusted off an article I wrote years ago—turns out, it’s more relevant than ever. Especially after headlines like this one from CNBC: “Markets Plunge as Trade War Tensions...

TSP Withdrawal Rules for Federal Law Enforcement: Avoid Penalties & Maximize Retirement Savings

TSP Withdrawals for Federal Law Enforcement: Avoid Penalties & Maximize Your Retirement Understanding the “Protecting Public Safety Employees Timely Retirement Act” If you’re a Federal Law Enforcement Officer (LEO) planning for retirement, understanding the...

The TSP’s Hidden Flaw: How Withdrawal Rules Could Cost Federal Retirees Thousands

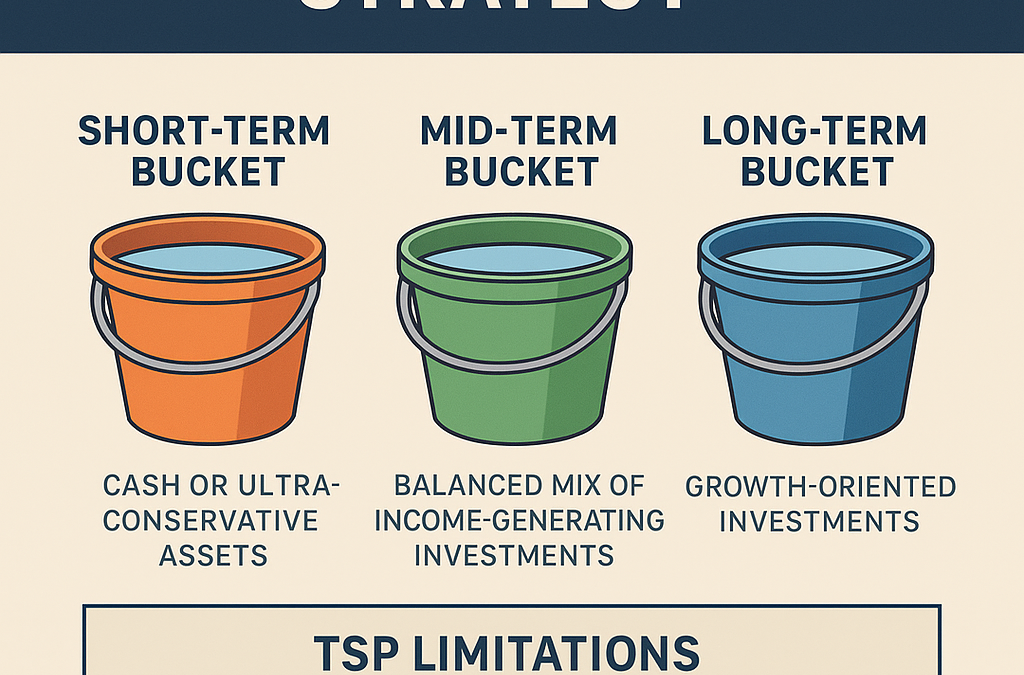

The Thrift Savings Plan (TSP) is pretty amazing in many ways. It’s low cost, easy to use, and offers matching contributions*—all of which make it a standout retirement savings option for federal employees. These features make it simple for participants to build a solid nest egg and retire comfortably.

But (and there’s always a “but,” right?) While the TSP shines when it comes to growing your money, it really drops the ball for retirees who are taking money out. It’s a bit like having the best tools to build a house, but no plan for how to maintain it once it’s done.