Knowing when to hold them and when to fold them.

According to the iconic Kenny Rogers song, the key to gambling is knowing when to hold’em and when to fold’em. When to stay the course, and when to make a change.

I hear this song in my head each time stock market goes south like the situation we find ourselves in presently. As of this writing the S&p500 is down 8.31% YTD, the Nasdaq is -13.04% YTD and the Russell 2000 index is-12.51%. * All in little less than a month.

It’s time like this that you may be wondering…

What’s going on? Do I need to make a change in our portfolios? What’s my plan? Mr. Financial Advisor, what are you going to do?

Like the song, do you hold onto your investments? Or do you fold your investments and ask for new cards?

Doing something feels better than doing nothing.

Before answering the question, we need to lay some emotional groundwork. All of us are biased ‘towards’ action. When confronted with a problem, we ‘think’ that we ‘need’ to do something.

As investors, it’s totally normal to view accounts losing money as indication that ‘something is wrong.’ Something needs to be done about it.

Here’s the hard truth. There is probably nothing wrong with your portfolio. Situation is normal.

Are we financial hypochondriacs?

Losing money doesn’t mean your portfolio is sick. Losing is a natural part of investing.

Never losing money? That’s not normal.

We only have to look towards the most famous Ponzi scheme in history to illustrate this point. We’ve all heard of Bernie Madoff’s and know his story. However, one of the most overlooked aspects of the rise and fall his scheme was the specifics of his investing strategy. He didn’t get his investor amazing returns. 40% or 50% returns? Nope.

So why did so many people trust him with their money?

He gave the consistency and peace of mind. The accounts (on paper) never, ever lost money. He gave the 1% per month, each month, rain or shine. If the market was up 30%, he gave them 1%. If it was down 30%, he gave them 1%. He never missed a month.**

As a Madoff investor, opening your statement each month must have been very reassuring. You never had to deal with what was really going on in the market—the normal ups and downs. The emotional appeal of this type of investing is strong. No wonder so many people go duped.

Of course, we know now that earning 1% per month, is impossible and not normal. It should have raised red flags but didn’t until it was too late for many people.

What is normal? Losses.

So—back in the real world, to earn those 10% rates of return, the cost of admission are market swings that are as routine as the seasons changing here in Michigan.

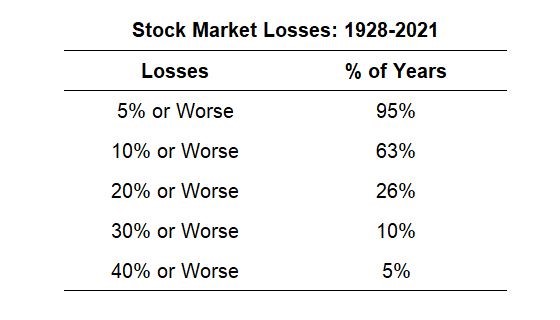

Take a look below—95% of the years we have experienced a 5% pull back at some point. 63% of those years we get drawdowns of 10%. Every 4 years we get a doozy—20% loss or more. ***

No action is an action.

As professional investors, we start with a bias towards ‘non action.’ We believe there needs to be something very wrong with the portfolio or the markets to make sudden change. We believe this because of all the research and work done in advance to design a portfolio that expects and weathers market turbulence.

Florida, Hurricanes and the stock market.

Think about this, if you live in place like Florida prone to hurricanes, wouldn’t it make sense to build a home with designed to withstand high winds? Of course!

What you would not do is act surprised by the ‘sudden’ occurrence of a hurricane and them complain about your misfortune for being ill-prepared. They expect Hurricanes. It’s called Hurricane season for reason.

The same lesson can apply to your portfolio. Thunderstorms and hurricanes are normal weather patterns for the market.

Did you build a portfolio with that in mind? If you did, then hunker down and trust your preparation will allow you to ride out the storm. You can know that your portfolio will ‘hold.’

Final lessons:

Market losses never feel good. I understand that. However, most investor mistakes are made in the heat of the moment, during the times of market uncertainty than when things are going poorly. Therefore, it’s important to remember some key lessons.

- We hard-wired for action. An action-bias in investing can work against you.

- Turbulence is normal and regular. The market doesn’t need a reason to drop. It’s the lack of turbulence is not natural. (Remember Madoff)

- Building a diversified portfolio in advance of market turbulence is crucial. Having thought out a hurricane plan for your portfolio before the storm hits a key ingredient in investing success.

Keep these three things in mind and you’ll be on the road to confident investing. In the meantime, stay warm!

Sources:

*https://www.google.com/finance/

** https://www.latimes.com/archives/la-xpm-2008-dec-13-fi-madoff13-story.html

***https://awealthofcommonsense.com/2022/01/how-often-should-you-expect-a-stock-market-correction/