According to the iconic Kenny Rogers song, the key to gambling is knowing when to hold’em and when to fold’em. When to stay the course, and when to make a change. The same can be of investing. to investing. When do you hold and when do you sell?

I hear this song in my head each time the stock market goes south. For example, although we are off to a better start in 2023, last year was rough for most investors. In 2022, The S&P 500 fell 18.1%, the NASDAQ did even worse, falling a whopping 32%.

Going into 2023 you may have been wondering…

- What in the world is going on?

- Do I need to make a change in our portfolios?

- When is it going to stop?

- Who’s to blame?

- Financial Advisor, what are you going to do?

It’s now July of 2023 and now that the market has ‘come back’ and some of those losses have recovered, what should you do?

Like the famous song, do you hold onto your investments? Or do you fold your investments and ask for new cards?

When to hold them and when to fold them. Doing something feels better than doing nothing.

Before answering the question, we need to think about our thinking for a moment. Many of us, when confronted with a ‘problem’ feel inclined to natural ‘fix it.’ Do something. As humans, we are biased towards action. As investors, it’s totally normal to view accounts losing money as indication that ‘something is wrong.’ When something is wrong, we fix it. Don’t we?

Here’s the hard truth. There might not be anything wrong with your portfolio.

Are we financial hypochondriacs?

Losing money doesn’t mean your portfolio is sick. Losing is a natural part of investing.

Never losing money? That’s not normal.

We only have to look towards the most famous Ponzi scheme in history to illustrate this point. We’ve all heard of Bernie Madoff’s and know his story. However, one of the most overlooked aspects of the rise of his scheme was the specifics of his investing strategy. He didn’t promise his investor amazing returns. 40% or 50% returns? Nope.

So why did so many people trust him with their money?

There are many reasons. But think one deserves attention. His returns (if we can call them that) gave his clients consistency and peace of mind. The accounts (on paper) never, ever lost money. He gave them 1% per month, each month, rain, or shine. If the market was up 30%, he gave them 1%. If it was down 30%, he gave them 1%. He never missed a month. **

As a Madoff investor, opening your statement each month must have been very reassuring. You never had to deal with what was really going on in the market—the normal ups and downs. The emotional appeal of this type of investing is strong. No wonder so many people get duped.

Of course, we know now that earning 1% per month is impossible and not normal. It should have raised red flags but didn’t until it was too late for many people.

What is normal? Both Gains….and… Losses.

So—back in the real world, to earn those 12% rates of return, the price you must pay is the occasional loss. And don’t be surprised, losing happens regularly. As common as the seasons change here in Michigan, markets go through a rainy season.

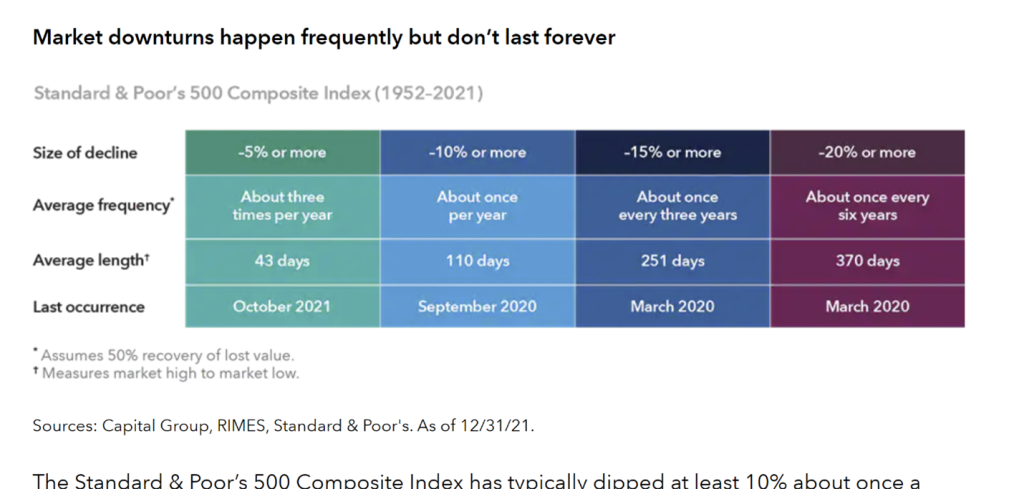

Take a look below, historically we lose 10% about once per year and 5% about every month 43 days. Percentages are a little abstract so let’s talk in real dollars. If your account was $100,000 you should expect that at some point, it could lose 10,000 this year (10%)

And not just this year, every year.

What you can do about it.

Remember the adage, don’t just stand there, do something! We like to take the opposite approach. We believe there needs to be something very wrong with the portfolio or the markets to make sudden change. We believe this because of all the research and work done in advance to design a portfolio that expects and weathers market turbulence. (Notice I didn’t say ‘predict’)

Florida, Hurricanes, and the stock market.

Think about this, if you live in place like Florida prone to hurricanes, wouldn’t it make sense to build a home designed to withstand high winds? Of course!

You would not be surprised by the ‘sudden’ occurrence of a hurricane and them complain about your misfortune for being ill-prepared. Floridians expect Hurricanes. It’s called Hurricane season for a reason.

The same lesson can apply to your portfolio. Thunderstorms and hurricanes are normal weather patterns for the market.

Did you build a portfolio with an occasional storm in mind? If you did, then when volatility inevitably arises, hunker down and trust that your preparation will allow you to ride out the storm.

Final lessons:

I’m not a robot. I understand that 2022 was a nervous year for our clients and investors. Market losses never feel good. I understand that. However, most investor mistakes are made in the heat of the moment, during the times of market uncertainty than when things are going poorly. Therefore, it’s important to remember the key lessons discussed here.

- We hard-wired for action. An action bias in investing can work against you.

- Turbulence is normal and regular. The market doesn’t need a reason to drop. The lack of turbulence is not natural. (Remember Madoff)

- Building a diversified portfolio in advance of market turbulence is crucial. Having thought out a hurricane plan for your portfolio before the storm hitsa key ingredient in investing with confidence.

- Keep these three things in mind and you’ll be on the road to confident investing. In the meantime, stay warm!

Sources:

*https://www.google.com/finance/

** https://www.latimes.com/archives/la-xpm-2008-dec-13-fi-madoff13-story.html

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.

The opinions and forecasts expressed are those of the author and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation for any specific security or investment plan. Past performance does not guarantee future results.”

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Asset allocation does not ensure a profit or protect against a loss. All indices are unmanaged and may not be invested in directly.