Bumped Up.

Misunderstanding tax brackets can cost you.

“Oh great, I got a bonus this year and now I’m up in a higher tax bracket. Most of my bonus is going to taxes!”

If I had a quarter for every time, I heard about someone complain about being ‘bumped up’ into another bracket I’d be a rich man. Besides being wealthy, you also could guess at my lack of social life since I seemingly only hand around people that talk about tax brackets. (Sorry, dad joke there)

All jokes aside, when I hear ‘bumped Up’ into another tax bracket I cringe at the this very basic, but extremely common misconception. I cringe because income taxes can be the biggest expense that we have, and that statement reflects a very, very wrong understanding of tax brackets.

Since we all pay a lot in taxes, it also pays to know how these things work. In the case of federal income taxes, a little bit of knowledge could potentially save you money.

After all it is Patriotic to pay taxes, but we don’t need to leave the IRS a tip. ????

My beef with the ‘Bumped Up’ statement.

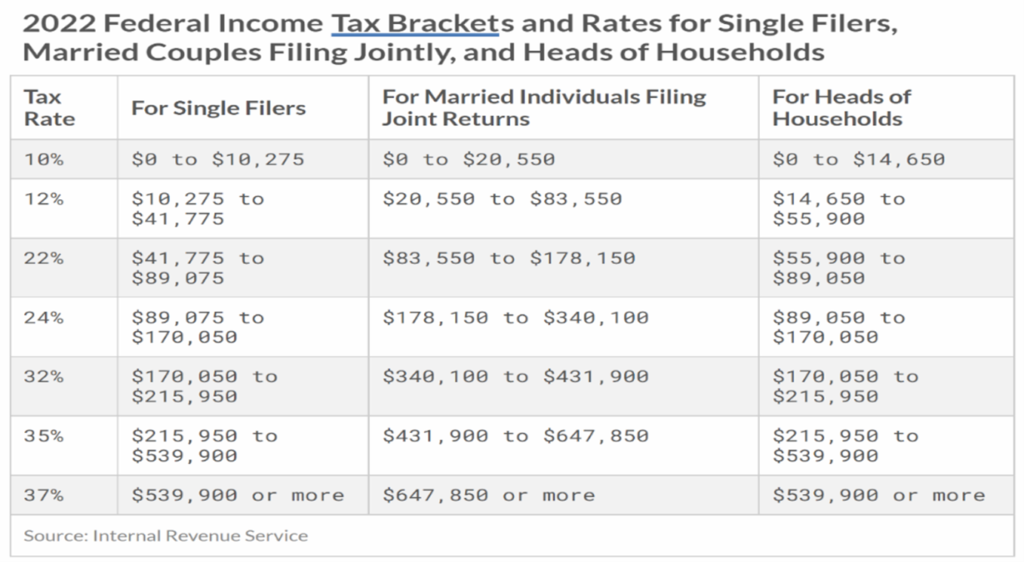

In this country we a progressive tax brackets system for federal income taxes. (we will leave the states out of this) As illustrated in the chart below, as you make more money, the percentage of tax you pay on that income also jumps. Therefore, by making more money you are exposed to higher tax brackets.

So, the ‘bumped up’ into another tax bracket is technically not wrong.

However, may people feel that when your income rises into that next tax bracket, 100% of the income will be taxed at the new higher rate. Not True.

When you ‘bump up’ into a new tax bracket, only the income that is within that tax bracket range will be taxed at the higher level.

For example, let’s say my friend complaining about his employer bonus normally earned $40,000 in income but received that $10,000 bonus at the end of the year to arrive at final income of $50,000. (We are going to keep it simple and only count income not deductions. We can save deductions that for another article)

By looking at the brackets again you can see he went from the 12% tax backet to the 22% tax bracket.

Many people might think that his entire income just bumped into the 22% bracket. He did and was adamant about the fact. By the way, this is based on actual conversation and he said something like what follows:

- I was paying 12% on my 40,000 income or $4800 in federal taxes

- I am now paying 22% on my new $50,000 income or $11,000 in taxes.

- My bonus was $10,000

- After-tax income only rose 35,200 to 39,000.

- My $10,000 bonus only got me $3800 in after tax income. So much for the bonus!

If you are like my friend, you might be thinking the same thing.

The truth.

Not all his income will not be taxed at 22%. Only the income within the 22% bracket will be taxed at this level. Referring to the chart, the 22% bracket is $41,775 to $89,075.

Rather than pay 22% on everything, he will pay 10% on the first 10,275 of income, 12% from 10,275 to 41,775, and 22% on the remainder up until 50,000.

I’ll break it out below.

- $10,275 X 10% $1,027

- $31,500 X 12% $3780

- $8225 X 22% $1809.50

Total $6616.50

His take home pay was a 43,383.50.

The average of all the tax brackets combined was 13.23% of income. Far below 22%.

The Takeaway:

My friend is not alone. I’ve come across many people that felt the same thing.

And certainly, knowing your top tax bracket (22% in this case) is important. However, knowing how tax brackets work, and where you fall in the spectrum is important. It can help you make better decisions through out the year. Two examples come readily to mind:

- While working, should you make your retirement contributions Pre-tax or Roth?

- Once retired does it make sense to withdraw funds from tax free accounts or taxable accounts?

Everyone’s situation is different but understanding tax brackets is an important first step in helping you make better decision for you. Remember taxes will be one of your largest expenses, if not THE largest expense. Let’s do our best to save as much as we can.

No ‘tip’ to the IRS right?

At minimum, you won’t feel bittersweet about those bonuses any longer!

Happy planning!

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

LPL Financial and its representatives, Mission Point Planning and Retirement do not provide tax or estate planning advice. These are services are provided in conjunction with a qualified tax and/or estate planning professional.

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC