The Road to being a TSP Millionaire: Staying Calm

The news has come out recently that number of TSP Millionaires just reached a record high!

As of December of 2023, a total of 116,827 people had reached that magical threshold. You might be wondering, how in the world did these people get to a million dollars in their TSP?

In our prior article, we discussed the two absolutely essential ingredients to become a TSP millionaire: Time and a strong stomach for market swings. And by ‘strong stomach’ all we mean is the fortitude to remain invested during market volatility.

The concept of ‘Time’ is easy to understand, but remaining invested, especially during market upheaval, is the real challenge. Therefore, in today’s article we will outline three strategies to help you with the course, remain invested and build wealth in your TSP on your way to retirement.

This is Robert Kiyosaki, author of the now classic Rich Dad/Poor Dad. (an amazing book) He has over 2 million followers and that tweet alone had 5.9 MILLION views! You may find yourself feeling his words make a lot of sense.

But when I hear predictions like this, I think of the following quote from Morgan Housel.

Pessimism is intellectually seductive in a way optimism only wishes it could be. Tell someone that everything will be great and they’re likely to either shrug you off or offer a skeptical eye. Tell someone they’re in danger and you have their undivided attention.

Well, his tweet brought a little attention from other experts, and it turns out, Robert is in the business of predicting crashes. He has been doing it for years now. Had you sold on one of his many earlier predictions, you might have cost yourself. Remember that the next time you hear doom and gloom!

Or better yet just turn off the TV.

Tip 2: Study the market history.

I travel a lot, and you would think that the more I travel the more I get used to flight turbulence, but it’s the opposite. I’m worse. When turbulence hits, I have a physical reaction, sweaty palms, my pulse increases, blood pressure rises. I know this is silly, but I can’t help it.

I can only manage it. However, the one thing that helps me the most is if the captain tells us in advance that they expect turbulence. For example, on a flight to Atlanta last week the captain greeted all the passengers warmly and said they expected a smooth flight, but with some light turbulence over Tennessee, which was about 90 minutes into the flight. If the turbulence was bad enough, he said they would change the flight path… but for now, they were going to stay the course.

When the turbulence did hit, I still reacted… but not with the same intensity. I think it was because of the following three reasons:

- The captain knew about it and expected it and told me about it.

- When it did happen, I wasn’t surprised.

- I knew he had a plan if it got really bad.

There are a lot of parallels between turbulence and market volatility. If you study market history, you can see that it is smooth sailing often and ROUTINELY interrupted by turbulence. Turbulence, no matter how disconcerting, is a normal part of flying just like it is a normal part of investing. It’s only when we forget about market history that ‘the turbulence’ makes us feel jittery and when we get jittery bad investment decisions happen.

Tip #3 Give yourself the 24-hour rule.

Did you know that people feel the pains of an investment loss with 2 to 3 times GREATER intensity than the pleasure of the same gain? Yes. If you make $10,000 in your TSP, you feel good. But if you lose $10,000? You will feel pain at a much greater level. Even a TSP Millionaire will feel this.

Psychologists call this Loss Aversion. This tendency is deeply rooted in our biology. Loss Aversion comes directly out of tendency to seek safety and is one of the reasons we made it to the top of the food chain. Having a finely tuned flight-or-fight response was an essential key to survival. As humans evolved, fearing ‘losses’ made us pay attention to threats and take them seriously.

Even though the world is a much different place since we were hunter/gatherers avoiding predators, we still have the same operating system. We remain hard wired for safety. However, what worked 10,000 years ago on the plains of the Serengeti does not necessarily bode well in the world of investing.

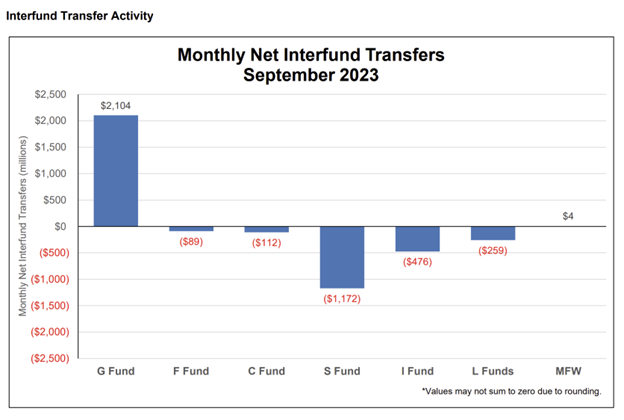

As evidence I don’t think you need to farther than the monthly fund flows into G-Fund. The numbers are overwhelming, assets routinely flow into the G Fund after the market drops and then back out of the G-Fund after the market rises. In September of this year, we saw a flight to safety with large influxes into the G-Fund and large outflows from the S-Fund.

Source: https://www.frtib.gov/pdf/minutes/2023/Oct/Att2-September-2023-Investement-Program-Review.pdf

According the TSP fund performance site, the S Fund lost 4.90% in September and 6.26% in October. So, investors started to bail.

Just in time to see the S-Fund rise 11.19% and 10.45% in November and December.

We call that buying high and selling low and investors do this all the time, even in the TSP. This is no way you become a TSP Millionaire.

Some people call this irrational investor behavior. I just call it being human.

I realize your TSP is not your life, but your retirement is important. When your investments drop, and those investments are part of your future financial security, it’s natural to feel threatened.

But do this enough and you will severely hurt your growth and in turn compromise your future financial security.

So, my suggestion the next time you are tempted to sell…

Do your own personal 24-hour rule.

I’ve coached high school sports for years and the 24-Hour rule is standard operation procedure for how we work with upset parents. When a parent is angry over their child, their biology overrides their rational brain and become so angry that they are literally not themselves. We ask them to wait 24 hours to discuss any issue with us. After a small wait, their brain chemistry has literally changed, and they are more normal or logical. They may still be upset, but the conversation becomes more productive than it would have been 24 hours earlier.

You can do the same thing, when you see something that scares you, you may become upset as one of the angry parents, remember this is normal. However, just wait, give it 24 hours, a few days, even a week. Any amount of time you need to gather your thoughts and let your rational brain take over.

TSP Millionaires, or any successful investor knows that investing in an emotional state never works. So don’t do it. The 24 Hour Rule will help.

Conclusion:Being a TSP Millionaire.

We have a saying, past performance doesn’t guarantee future results and although this is true, you can look at those that have invested successfully and try to copy their habits.

One habit we know gives us a greater chance in investing is the ability to STICK to a long-term goal even during after short term setbacks or market concern.

If you want the miracle of compound interest to work its magic, you HAVE to give it time,

And you my friend are the greatest threat to giving it time.

The next time you feel triggered to detonate your investment plan, keep in mind our three tips.

- Take a media diet.

- Study Market History

- Give yourself the 24-Hour rule.

And if all else fails, forget the password on your TSP website so you can’t trade.

Happy investing.

You can read this article as well as others we’ve written at Fedsmith.com.