💥 Tax Bracket Panic? Why Federal Employees Shouldn’t Fear a Raise

How Misunderstanding Federal Employee Tax Brackets Can Cost You—Now and in Retirement

“I Got a Raise, But Now I’m in a Higher Tax Bracket!”

If I had a dollar every time a federal employee said that, I’d have enough to max out my Thrift Savings Plan (TSP).

All jokes aside, this fear comes from a common misunderstanding of how federal employee tax brackets really work. Many think their entire salary is taxed at the highest rate once they move up a bracket—but that’s not true.

Let’s clear it up and help you keep more of what you earn.

.How Federal Tax Brackets Actually Work

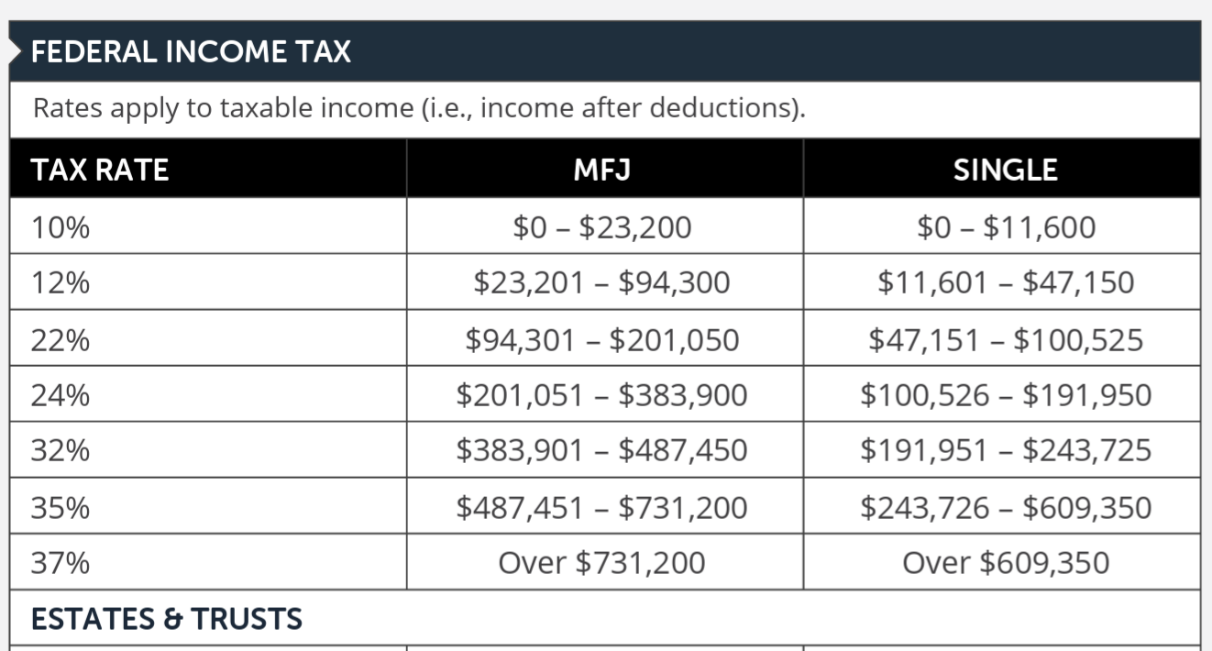

The U.S. tax system is progressive. That means your income is taxed in layers, not in one big chunk. And this applies to federal employee tax brackets, too. Which means that higher tax rates apply only to the portion of your income that falls within each bracket—not to your entire salary. (Numbers below are from 2024 tax year. source irs.gov)

While it’s technically true that earning more can push income into a higher tax bracket, only the income above a certain threshold gets taxed at the higher rate—not everything.

Example: A Mary from the VA Gets a Step Increase

Let’s say Mary, a VA Benefits Coordinator and GS -12 Step 3 employee earning $100,000 gets a step increase to Step 4, raising their salary to $103,000

Since this is tax season after all, she took an additional step of reviewing the tax brackets and didn’t like what she saw and sighed…’I won’t see a dime of that raise.’

After looking at the brackets she realizes she’s been ‘Bumped Up’ to a new tax bracket.

Her prior income of a100,000 had been in the 22% bracket and her new step increase brought her into the 24% bracket. (for the sake of illustration, I’m not factoring in deductions)

She assumes this means her entire salary is now taxed at a higher rate, like this:

- Before Step Increase: $100,000 taxed at 22% = $22,000 in taxes

- After Step Increase: $103,000 taxed at 24% = $24,720 in taxes

- Take-home pay difference: Only an extra $280 after taxes on a $3,000 raise?!

“So much for my raise!” Mary utters.

But here’s what actually happens:

How Their Taxes Are Really Calculated

For single filers like Mary in 2024, the tax brackets* are:

- 10% on income up to $11,600

- 12% on income from $11,601 to $47,150

- 22% on income from $47,151 to $100,525

- 24% on income from $100,526 to $191,950

Since her new salary is $103,000, only the portion above $100,525 (just $2,475) gets taxed at 24%. The rest is still taxed at the lower 22% or below.

Mary’s total Federal Tax Calculation:

- First $11,600 taxed at 10% = $1,160

- $11,601 – $47,150 taxed at 12% = $4,270

- $47,151 – $100,525 taxed at 22% = $11,762

- $100,526 – $103,000 taxed at 24% = $594

Total Taxes Owed: $17,786

That’s only $594 more in taxes—far from losing most of the raise!

What We Can Learn from Mary: Effective vs. Marginal Tax Rate

Now that we understand not all income is taxed at the same rate, let’s explore two key tax concepts that Mary was unfamiliar with—Effective Tax Rate and Marginal Tax Rate (sometimes referred to as the “top rate” or the rate at which additional income is taxed).

The effective tax rate represents the average percentage of your total income that you pay in taxes. This is what Mary didn’t fully understand. This rate provides a clearer picture of your overall tax burden compared to the marginal tax rate, which refers to the highest tax bracket you fall into.

What Is My Marginal Tax Rate?

Your marginal tax rate is the percentage of tax applied to your last dollar of income. This rate determines how much additional earnings—such as a raise, bonus, or retirement withdrawal—will be taxed.

In Mary’s case, her marginal tax rate is 24%, but her effective tax rate is only 17.2%.

Hardy a large bump up!

What This Means for Federal Employees

Just knowing the basics of tax brackets and the difference between effective and marginal rates will help immensely. Taxes don’t have to be a confusing mystery understood only by experts. By familiarizing yourself with just three core concepts you can take a more strategic approach to tax planning and make informed financial decisions.

For Active Employees Like Mary just remember:

✅ Your raise won’t be taxed at a higher rate in full—only the portion in the next bracket.

✅ Knowing your brackets and tax rate can help decide on Traditional or Roth TSP contributions.

___________________________________________________________________________________

What This Means for Federal Retirees

What happens when Mary retires? Now the real fun begins.

Understanding federal tax brackets isn’t just important for active employees—it’s arguably even more critical for retirees.

If you’re retired under the Federal Employees Retirement System (FERS), you likely have multiple sources of income, each taxed differently. Knowing your tax brackets is essential for structuring a tax-efficient retirement income plan. (hopefully you have one of these!)

A helpful way to think about this is to visualize your income as a layered cake, with each layer representing different income sources that contribute to your overall tax burden. By understanding how these layers stack up, you can make more strategic decisions to minimize taxes and maximize your retirement income.

___________________________________________________________________________________

Creating your own Retirement Income “Layer Cake”

Layer 1: Guaranteed Sources of Income (Fixed & Recurring)

These are your retirement paychecks— arrive every month, regardless of market conditions, and count toward your taxable income whether you like it or not. (of course, who would refuse a paycheck?!)

✅ Social Security – Up to 85% of your benefits may be taxable, depending on your total income. (we will leave the supplement for another article)

✅ FERS Annuity (Pension) – 100% taxable as ordinary income.

Going back to Mary let’s assume she receives:

- $35,000/year from her FERS pension

- $25,000/year from Social Security

Her cake layer of guaranteed income totals $60,000, which already places her partially into the 22% tax bracket for single filers.

Layer 2: Non-Guaranteed Sources of Income (Variable & Withdrawals-Based)

These income sources aren’t automatic—you (and Mary) choose when and how much to withdraw, which determines your taxable income.

✅ Thrift Savings Plan (TSP) Withdrawals

- Traditional TSP: Fully taxable as ordinary income

- Roth TSP: Tax-free withdrawals (if qualified) and don’t add to your tax burden.

- The amount you withdraw determines the SIZE of the layer and the SIZE of the tax bill.

- Taking out $10,000 to pay for extra living expenses is adding 10K of income on TOP of your layer cake.

- Taking out $300,000 to pay off a house is adding 300K of extra income on TOP of your layer cake.

The Tax Impact of Mary’s Patio Renovation

Going back to Mary…after retirement she decides she needs an extra $100,000 to cover her dream patio renovation. She plans to withdraw the entire amount from her Traditional TSP.

Like many FERS retirees, Mary was told throughout her career that she would be in a lower tax bracket in retirement, so she contributed 100% of her savings to a Traditional TSP

However, because these funds were Pre-tax, her entire withdrawal is now subject to income tax.

As a result, her total taxable income jumps to $160,000:

- $60,000 from her pension and Social Security

- $100,000 from her TSP withdrawal

Why Understanding Tax Brackets Matters in Retirement

I can’t emphasize the next point enough. Once Mary retired, she controlled how much taxable income she generates each year by the amount she withdrew from her traditional TSP, regardless the reason.

Consequently, managing and planning your withdrawals wisely can help minimize taxes and can prevent Social Security from being taxed at higher rates.

You can see how this plays out with Mary’s TSP withdrawal.

Tax Consequences of a $100,000 TSP Withdrawal

- The first $40,525 of the withdrawal stays in the 22% tax bracket.

- The remaining $59,475 is taxed at 24% because it pushes her income past the 22% bracket.

- Since TSP withholds only 20% for federal taxes, Mary could still owe additional taxes at the end of the year.

Mary’s Unintended Consequence: Higher Medicare Premiums

Mary’s patio is getting more expensive by the minute—not just in taxes, but also in unexpected Medicare costs. (she decided to add this to her FEHB)

What Mary didn’t realize is that if her Modified Adjusted Gross Income (MAGI) exceeds certain thresholds, she could face higher Medicare Part B and Part D premiums due to Income-Related Monthly Adjustment Amounts (IRMAA).

Because she withdrew $100,000 from her Traditional TSP, her MAGI likely exceeded the IRMAA threshold, triggering increased Medicare premiums for at least the following year. This means her Medicare costs could rise significantly, reducing the amount of retirement income available for other expenses.

How Mary’s TSP Withdrawal Triggered IRMAA Surcharges

For 2024 IRMAA*** thresholds, if Mary’s MAGI exceed $103,000 (for single filers), she will pay higher Medicare premiums in 2026 (since IRMAA surcharges are based on income from two years prior).

Mary’s Total MAGI After a $100,000 TSP Withdrawal

| Income Source | Amount | Taxability |

| FERS Pension | $35,000 | 100% taxable |

| Social Security | $25,000 | Up to 85% taxable (~$21,250 included in MAGI) |

| Traditional TSP Withdrawal | $100,000 | 100% taxable |

| Total MAGI | $156,250 | (Well over IRMAA threshold) |

Since Mary’s MAGI is $156,250, she falls into the $129,001 – $161,000 IRMAA bracket, meaning:

🚨 Her Medicare Part B premium will increase from $174.70 to $349.40 per month (+$174.70/month).

🚨 Her Medicare Part D premium will include a $33.30/month surcharge.

Total extra Medicare costs due to IRMAA = $2,500+ per year 💸

_____________________________________________________________________________________________

How Mary Could Have Avoided Some Tax and Medicare Pain

📌 Option 1: Smaller Withdrawals Over Multiple Years

✅ Instead of withdrawing $100,000 all at once, Mary could have spread withdrawals over 2–3 years to stay below IRMAA thresholds and remain in the 22% tax bracket, reducing both taxes and Medicare costs.

📌 Option 2: Roth TSP or After-Tax Withdrawals

✅ If Mary had Roth TSP funds, she could have withdrawn some tax-free, with no impact on her federal employee tax brackets while keeping her Modified Adjusted Gross Income (MAGI) lower and avoiding a Medicare premium hike.

💡 Lesson for current employees: If you’re still working, consider contributing to a Roth TSP for greater tax flexibility in retirement.

📌 Option 3: Don’t Get the Patio… But Where’s the Fun in That?

✅ Like Mary, you retired for a reason—to enjoy life! The key is planning ahead so you can make big purchases without unnecessary tax and Medicare surprises.

Moral of the story? A little tax planning can go a long way in maximizing your retirement income while still funding your dream project.

The Takeaway

Misunderstandings about federal employee tax brackets often start during our working years and, if carried into retirement, can lead to costly mistakes for federal retirees.

Staying informed about your tax situation each year ensures you have the best information to make smart TSP saving and withdrawal decisions.

💡 Take control of your financial future, review your tax strategy annually and make adjustments as needed.

❓ Not sure whether to contribute to a Roth or Traditional TSP?

❓ Wondering how to structure a tax-efficient retirement distribution plan?

We can help! Reach out today to take control of your retirement strategy.

And remember—while taxes are unavoidable, tipping the IRS is completely optional!

Happy planning! 🎯🚀

Disclaimer: This material is for informational purposes only and should not be considered tax or financial advice. Consult with a qualified tax professional or financial advisor for guidance on your specific situation.

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.

*https://www.irs.gov/filing/federal-income-tax-rates-and-brackets